Focus on what you can control

When it comes to investing, there are several things that are not in our control as investors. The economic conditions, events triggering changes in the market, how the market reacts to such conditions and hence the returns in the near term, and so on.

But there are still some things that we (the investors) can influence.

1. The amount we can put into investments

2. The time period of our investments

In the Compound Interest formulae, out of three factors namely, invested amount, interest (returns), and the number of years invested, we focus more on the returns, while the other two also influence the overall growth of the investment fund.

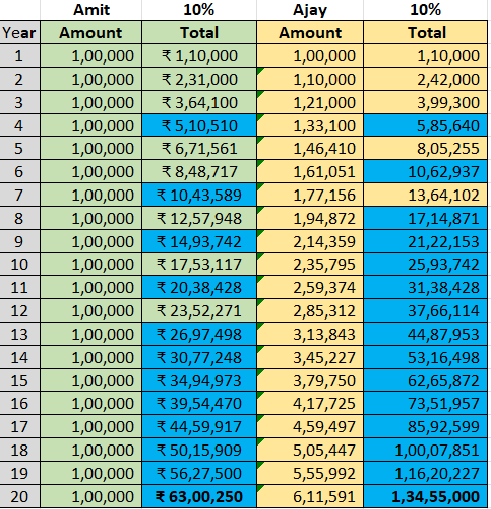

Here is an illustration where Amit and Ajay begin investing Rs.1 lakh each year (about Rs.8000 per month) into a well-researched product. As soon as he received his raise, Ajay made a conscious decision to raise his investments by 10% annually. Both of them continued to invest for 20 years without redeeming at any time during the period.

Here are some observations from the 20 years of their investment journey.

At the end of the 20 years period, Ajay had made more than 100% of what Amit made!

Amounts highlighted in ‘Blue’ are where additional 5 lakhs were achieved. During his fourth year, Amit earned his first “5 Lakhs.” His subsequent “5 Lakhs” was made in under three years. He started making “5 Lakhs” every year after 13 years of consistent investments. This is the magic of compounding!

Ajay achieved the same even sooner than Amit.

After all, we are making an investment toward our goal, and achieving that goal is our first priority. Hence, it is prudent to take advantage of the factors we have under our control rather than solely relying on external factors to build investments.

#Consistency #Compounding #Investment #planning