Dreaming of a luxury car?

Sanjay and Akshay began their corporate careers together. They both dreamed of owning a luxury car.

Their salary had increased significantly in 2017.

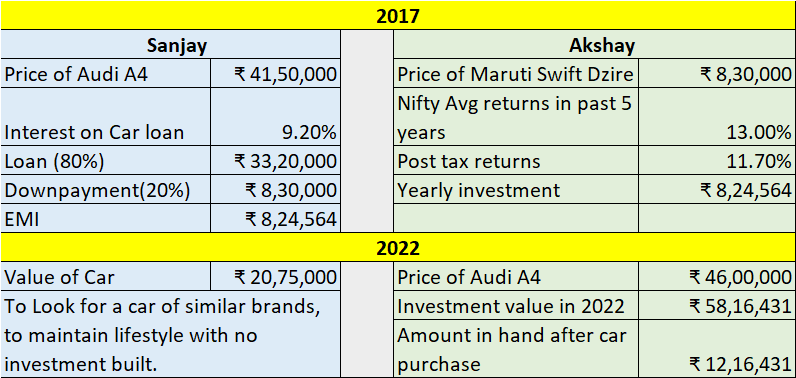

Sanjay was considering an Audi A4. Sanjay decided that now would be a good time to purchase the Audi because he could comfortably afford the EMI. The car would cost him 41.5 lakhs.

He applied for a car loan for 80% of the car’s value for 5 years with a 20% (~8.3 lakhs) down payment. Each year, he spent almost 8.2 lakhs on EMIs.

Akshay had different ideas. He did not want to go for a luxury car right away. He purchased a high variant of Maruti Swift Dzire for 8.3 lakhs approx. He invested the 8.2 lakhs each year, that Sanjay paid in EMIs, into the Nifty index over a five-year period.

Sanjay finished repaying his loans at the end of 2021.

At the same time, Akshay was hoping to purchase the identical Audi A4. Today, he would have to pay 46 lakhs for the same car.

However, considering the post-tax returns from the nifty over the previous five years, his assets had increased to roughly 58 lakhs.

Without taking out any loans, he was able to finance his dream car and had an extra 12 lakhs or so.

In these five years, Sanjay’s car value decreased by 50%. In a few years, he should start looking for a new vehicle.

He is currently unable to escape this lifestyle trap and is once more considering taking out EMIs to buy a new luxury car. This cycle goes on.

Planning and Patience pay off in the long term.

#luxury #Merc #Benz #Patience #planning